Graphic: Cox Automotive

New-vehicle inventory closed September at its highest level since early June 2021, and the average listing price for new vehicles fell to the lowest point in two months, according to Cox Automotive’s analysis of vAuto Available Inventory data released Oct. 13.

Still, supply remains well below historical norms, and prices are still far higher than in the past. “Supply is improving but demand is staying strong so we’re still not back to inventory levels of years past,” said Charlie Chesbrough, senior economist at Cox Automotive, in a news release. “Despite elevated vehicle prices, soaring interest rates and high inflation, we see no signs that demand is falling off, at least, not yet.”

The total U.S. supply of available unsold new vehicles stood at 1.32 million units near the end of September, compared with a revised 1.23 million vehicles at the end of August. Days’ supply edged up to 42 at the end of September compared with a revised 41 at the end of August.

Supply at month’s end was 54% higher, or 465,000 units, than at the end of September 2021. Days’ supply was 40% higher than at the same time a year ago. While that is a big bump, inventory remains low by historical standards. At the end of September 2020, supply stood at 2.46 million vehicles for a 57 days’ supply. For the pre-pandemic 2019 period, inventory hit 3.45 million vehicles for an 80 days’ supply.

Closing September, the industry had non-luxury vehicle inventory totaling 1.12 million vehicles for a 42 days’ supply. That was up from 1.02 million a month earlier for a 40 days’ supply. Luxury supply stood at 199,975 vehicles for a 47 days’ supply, compared with a month earlier when inventory was just shy of 125,000 units for a 44 days’ supply.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, in this case, ended Sept. 26, when about 937,665 vehicles were sold. According to Kelley Blue Book calculations, new-vehicle sales in September totaled 1.12 million units, up 10% compared to September 2021, but down slightly from August. This September’s seasonally adjusted annual rate (SAAR) was 13.5 million, up from 12.3 million in September 2021, when the chip shortage was at its worst, and up from 13.1 million in August.

New-Vehicle Asking Prices Begin to Retreat

The average listing price – or the asking price – dipped to $46,294 in September, down from a revised $46,398 at the end of August and the lowest level since mid-July, according to Cox Automotive’s analysis of vAuto Available Inventory data. The listing price is running 7% ahead of a year ago and remains elevated from years past. In September 2020, the average listing price was $38,662. In pre-pandemic September 2019, it was $37,110.

The average transaction price (ATP) – the price people paid – retreated from record levels in September at $48,094, according to Kelley Blue Book. September prices dipped 0.3% ($146) from August but were up 6.1% ($2,775) year over year from September 2021. September marked a record 16th straight month of ATP being above sticker price.

Incentives decreased again in September to only 2.1% of the average transaction price, a record low. A year ago, incentives averaged 5.2% of ATP. “If we see inventory build quickly, we can expect increased incentive activity,” Chesbrough said. “Certain brands and models have higher inventory and could be among the first to offer incentives.”

Luxury vehicles have been accounting for a historically high share of new-vehicle sales; that share was 18% in September. The average listing price for luxury vehicles was $65,935 at the end of August, Cox reported. The non-luxury average list price was $44,559 at the end of August. The average transaction price for non-luxury vehicles dipped to $44,215 in September and to $65,775 for luxury vehicles.

Prices are expected to stay high due to continued strong demand, low inventory, record-low incentives and a rich mix of vehicles being made by automakers to buoy profits and revenue. Automakers still are prioritizing available computer chips to high-end, high-margin models instead of entry-level vehicles.

Asian Auto Brands Still Have the Lowest New-Vehicle Supply

Asian non-luxury brands and Japanese and European luxury brands had the lowest inventories. Non-luxury brands with the lowest inventories were Kia, Toyota, Honda and Subaru. Luxury brands with the lowest inventories were Lexus, BMW, Acura and Land Rover.

Volvo had the highest inventory of all brands as measured by days’ supply. Other luxury brands with above-average inventory were Lincoln, Buick and Audi. Once again, on the non-luxury side, Stellantis brands – Ram, Jeep and Dodge – had the highest inventories.

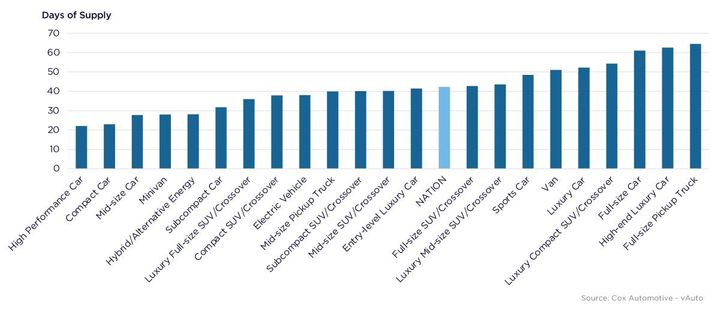

Aside from low-volume high-performance cars, segments with the lowest inventory were mostly highly fuel-efficient cars, including subcompact, compact and midsize cars, hybrids, and minivans. Demand for fuel-efficient vehicles rises as gas prices increase.

Full-size pickup trucks from domestic automakers had the highest inventory, back to levels similar to pre-pandemic days. As has been the case for months, larger and luxury cars also had inventory at the higher end of the spectrum.

Almost half of the 30 highest-selling models in the 30 days that ended September 26 were Asian brands, mostly Kia, Toyota, Honda and Subaru. Kia Telluride was at the very bottom with a scant 16 days’ supply. Of the 30 top-selling models, full-size domestic pickup trucks and SUVs had the most inventory.

In terms of price categories, the lower the price, the tighter the supply. Price categories under $30,000 had the lowest days’ supply at around 30. The $30,000 to $40,000 segment, the largest volume category, had a 35 days’ supply. The $40,000 to $50,000 category had a 42 days’ supply. The more expensive categories had above 50 days of supply.

Originally posted on Vehicle Remarketing

For GREAT deals on a new or used Nissan check out Nissan of Staten Island TODAY!